Child Tax Credit 2024 Taxes Income Limits – the IRS website You have a modified adjusted gross income, or MAGI, of $200,000 or less, or $400,000 or less if you’re filing jointly. Note: . A guide to the Child Tax Credit in 2024. The child tax credit stands as a significant federal tax benefit designed to offer financial support to American taxpayers raising children. This credit allows .

Child Tax Credit 2024 Taxes Income Limits

Source : www.marca.com

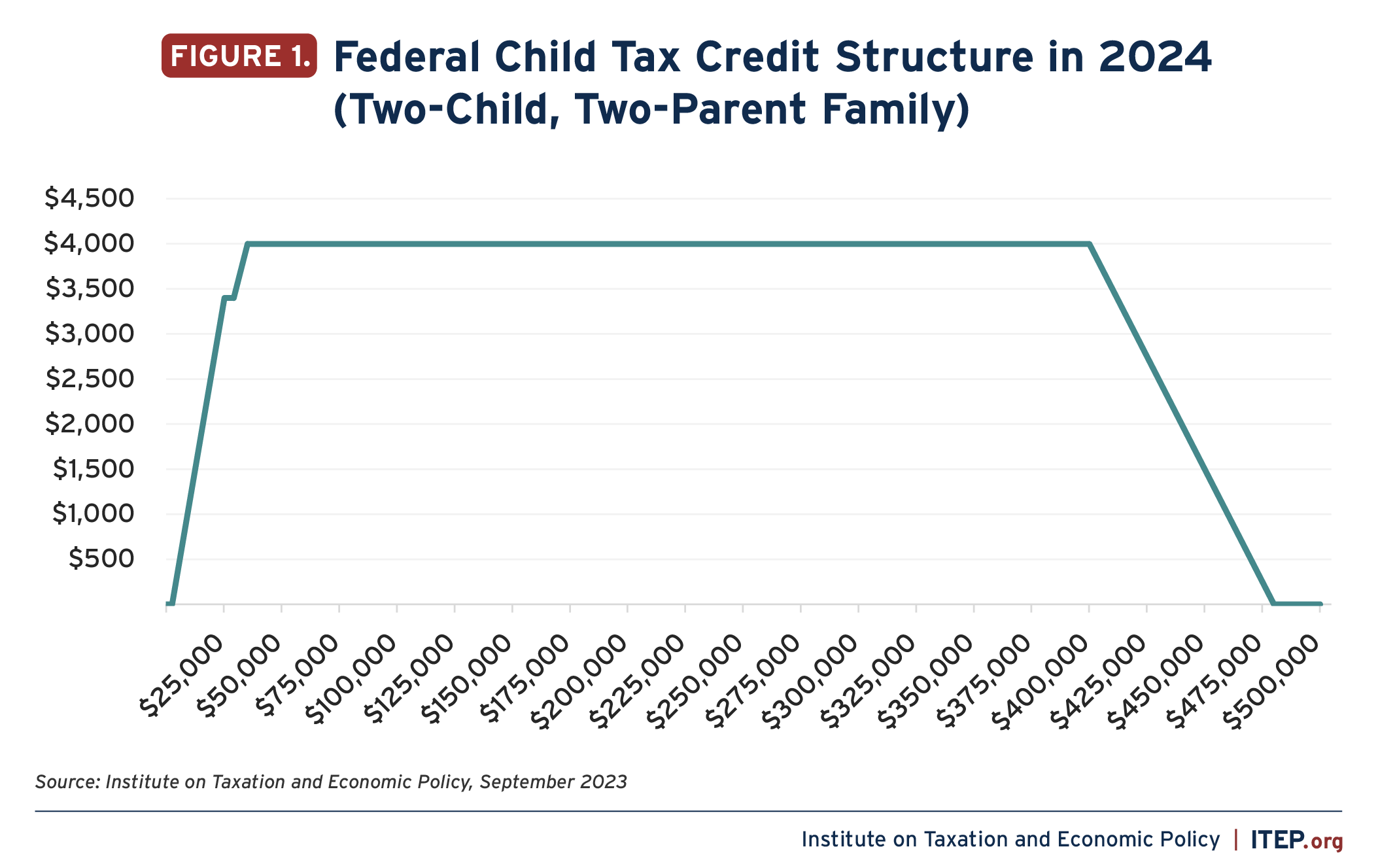

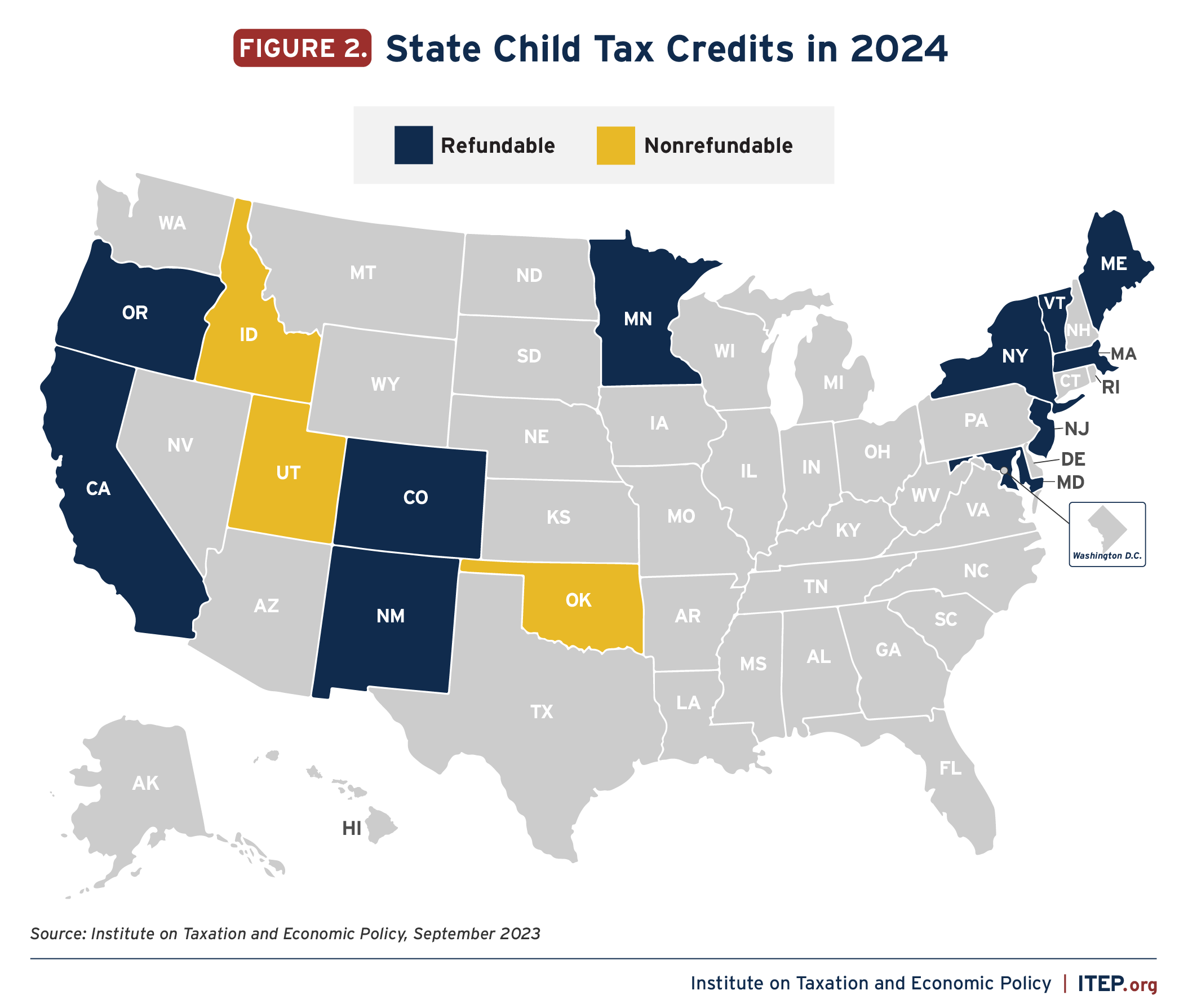

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2024: Should You Wait to File Your Taxes? CNET

Source : www.cnet.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

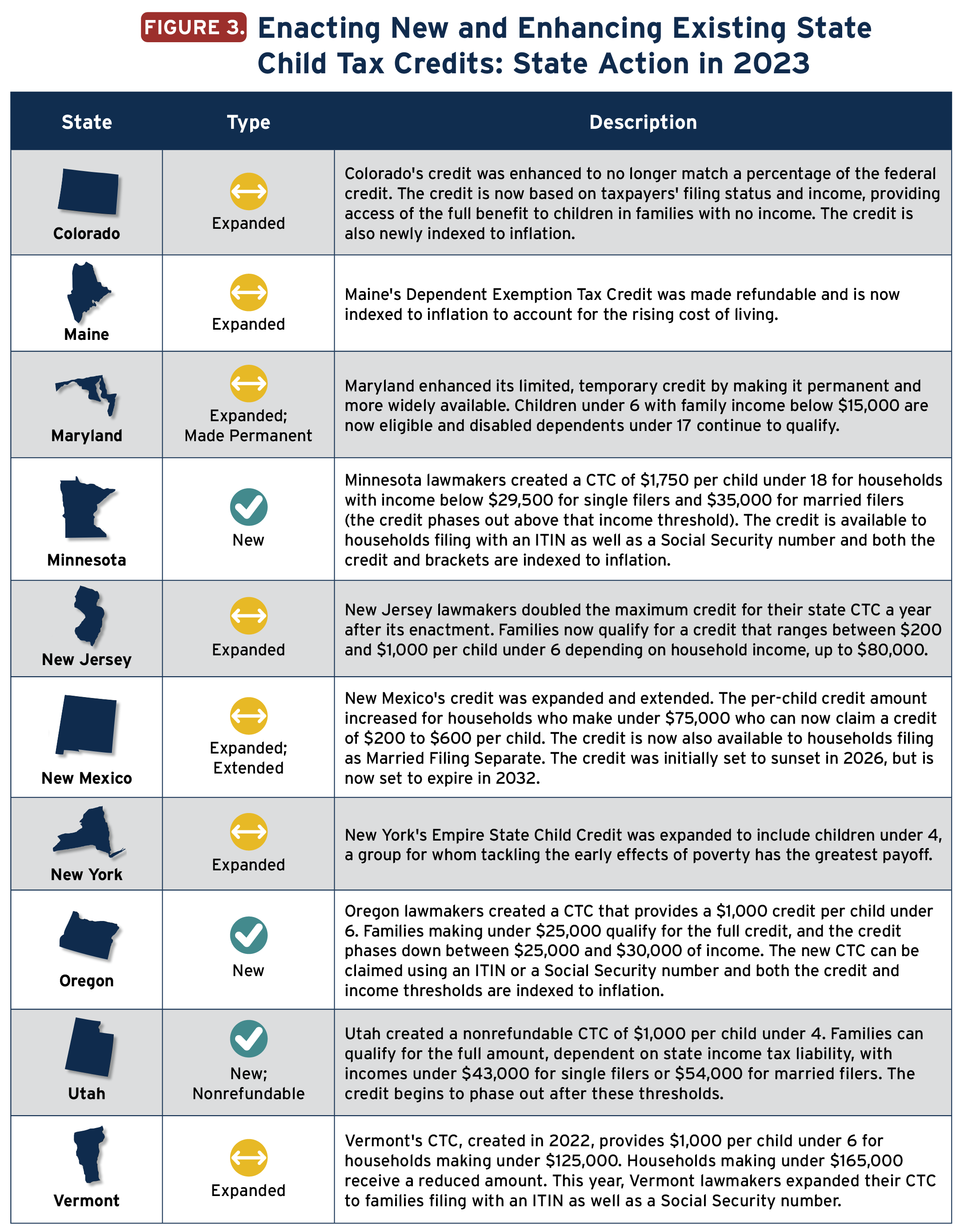

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Taxes Income Limits Child Tax Credit 2024 Income Limits: What is the income limits for : either because of the discount they will obtain on their taxes or because of the refunds they can get by applying the additional child tax credit (ACTC). Families who are low-income or who, for some . For 2023 tax year, the maximum tax credit available per child is $2,000 for each child under 17 under Dec. 31, 2023, CNET reported. If you are eligible, it could reduce how much you owe in taxes but, .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)